TL;DR: Adaptive Issuance has been revised in close cooperation with Tezos ecosystem stakeholders. This post recaps what Adaptive Issuance means for Tezos staking, and what’s different in the Paris proposal.

Since its launch in 2018, the Tezos protocol has emitted a fixed number of tez, roughly 5% of the total supply per year, as rewards to those securing the network, bakers.

5% of the total supply is more than enough to incentivize a secure network, and as a result most rewards received by bakers are re-distributed to tez holders through the delegation system. However, over time this approach has been seen to cause friction with real-world use of Tezos, as we’ll expand on below.

Adaptive Issuance is a mechanism for letting the network automatically set the rate to the minimal level necessary to secure the network, thereby minimizing inefficiencies that arise from the re-distribution of rewards.

The mechanism continuously adjusts the rewards based on a target ratio for tez staked out of the total supply. When the ratio is below the target, the protocol increases rewards to encourage more staking. When it’s above the target, the protocol reduces rewards to minimize dilution.

This way, the Tezos protocol emits only as much new tez as needed to achieve a desired security level – no more, no less.

Below we look into why it matters. A more in-depth discussion of arguments for (and against) can be found in this Tezos Agora post.

Lower rates, less dilution, minimal friction

The market for delegation suggests that the reward required to incentivize a secure network, the security budget, is notably lower than the current 5% rate.

The delegation system essentially lets tez holders 1) contribute to staking and governance, and 2) minimize dilution by being refunded any “excess inflation” beyond what bakers require to secure the network. Bakers typically share 80-90% of rewards with delegators, indicating that current rewards are somewhat higher than what’s required.

With Adaptive Issuance, rewards adjust towards a ‘minimal viable level’ to avoid excess inflation. It has the important effect of greatly reducing the opportunity cost of undelegated tez, which makes Tezos better adapted to real-world use:

- Better composability. Tez becomes more attractive for use in lending markets, DeFi, rollups, etc. Needing to delegate creates friction when lending, locking or pooling tez, as it raises questions about who gets rewards and who votes in governance. Technical workarounds exist, but they also add friction.

- Simpler for custodians. Redistributing baking rewards requires some administration, and it’s an area likely to see increased regulation. Lower rewards makes it less important for custodians, such as exchanges, to engage in baking to avoid dilution of users’ funds.

- Tax considerations. Some jurisdictions tax received rewards as income irrespective of whether they simply serve as compensation for dilution or are created by the validators themselves. A lower rewards rate lowers the potential tax liability.

More at stake for a more secure network

Less incentive to delegate carries risk of less tez being involved in staking and governance.

To avoid this, the target percentage for staked funds is set to 50% of total tez supply, and reward rates will continuously adjust to incentivize this level.

The 50% target increases network security while still leaving plenty of liquid tez in circulation. It’s lower than the 70% currently involved in staking (baker funds + delegated funds), but requirements for staked funds under Adaptive Issuance are stricter than for delegation.

Delegated funds are not frozen or subject to economic penalties for dishonest baker behavior, slashing. They merely assign staking rights and governance voting power to the baker. The 50% target under Adaptive Issuance requires funds to be actually at-stake, i.e. frozen and subject to slashing. This is equivalent to what the current system requires for baker security deposits, which only make up around 7% of total supply today. Under Adaptive Issuance, staked funds are the security deposits.

So while 50% appears lower than 70%, the “quality” of the stake is much higher and should rather be compared to the 7%.

The new staker role

Currently only funds in the baker’s address can be frozen and slashed. Achieving 50% would be difficult to achieve purely with bakers’ funds.

To address this, the Paris proposal introduces the role of staker, which can be seen as a step up from delegator. Staked funds contribute to a baker’s staking and voting power, and are also frozen and subject to slashing. However, the baker never takes custody of the funds, and they never leave the staker’s wallet. The protocol handles the staking assignment and freezing of funds.

Rewards accrue to stakers directly from the protocol, without the baker’s involvement, unlike delegation where rewards are paid to the bakers who then pay delegators. In-protocol accrual means more security for external stakers, and further reduces the administrative burden for bakers.

Classic delegation remains possible, but to incentivize staking and compensate for the added risk, staked funds carry double the weight when assigning baking rights and in governance votes.

Bakers define if they’re open to external stake and how much they’re willing to accept, with a maximum of 5x their own stake. The baker can also define a fee that is taken out of rewards accruing to externally staked funds.

External stake beyond the baker’s limit will still be frozen, but is treated as delegated when it comes to rights assignment, governance votes, reward payouts, and in case of slashing.

| Currently | Adaptive Issuance | ||||

| Baker security deposit* | Delegated funds | Baker stake* | External stake* | Delegated funds | |

| Frozen and slashable | Yes | No | Yes | Yes | No |

| Baking rights / voting power | 100% | 100% | 100% | 100% | 50% |

| Control of funds | Baker | Delegator | Baker | Staker | Delegator |

| Who pays out rewards | Protocol | Baker | Protocol | Protocol | Baker |

| Counts towards staking target | N/A | N/A | Yes | Yes | No |

| *Funds held by the baker beyond the security deposit / stake are treated as delegated. The same applies to external stake that exceeds the baker’s limit. | |||||

What’s new in Paris

Adaptive Issuance in the Paris protocol proposal is a modified version of what was previously proposed in the Oxford proposal, which did not reach the required supermajority for adoption (a revised Oxford proposal without Adaptive Issuance, Oxford 2, was later adopted).

The changes highlighted here are the ways in which the Paris version differs from the Oxford version. They are the result of several extensive feedback rounds involving the wider ecosystem.

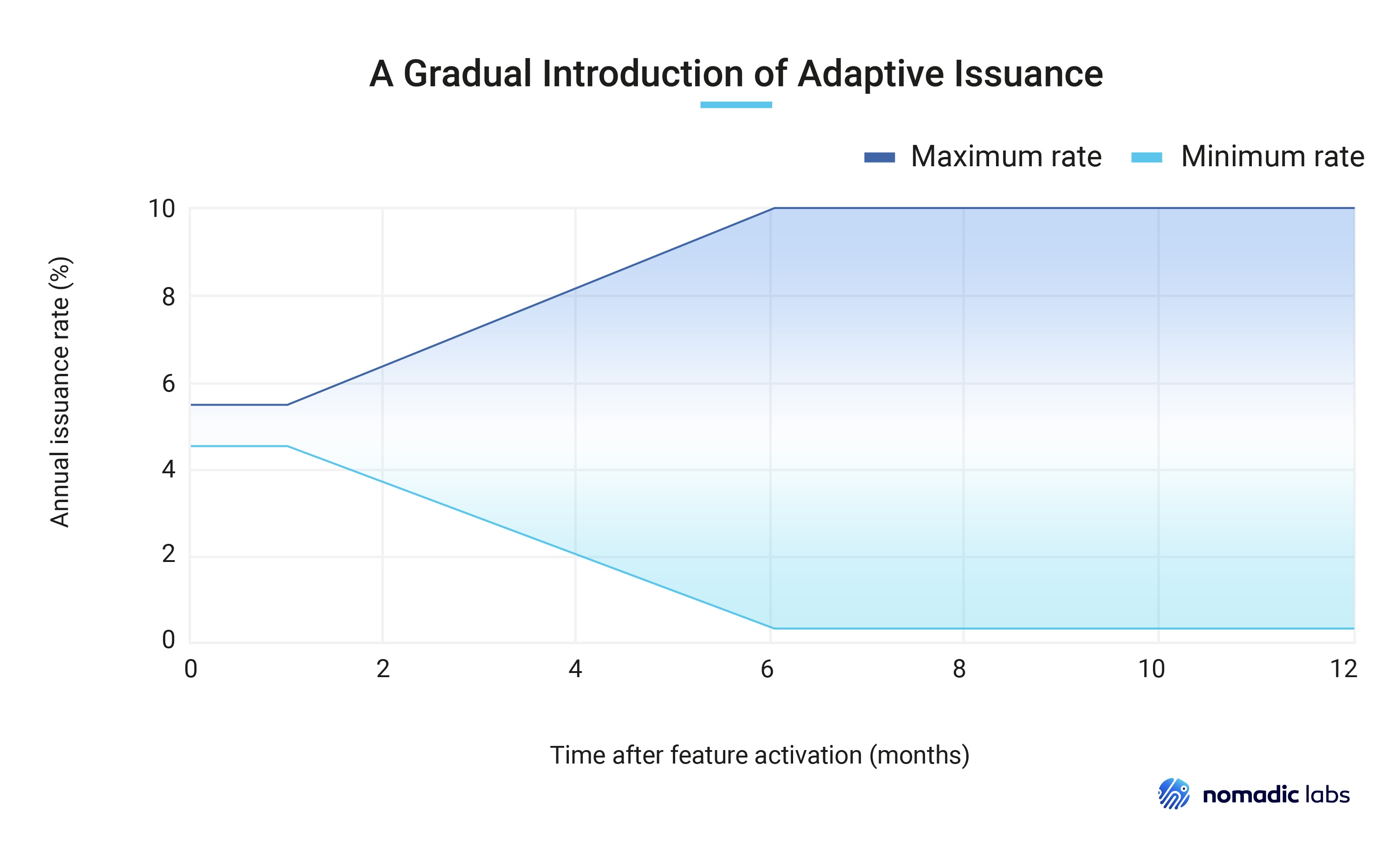

Progressive min-max rate. After activation, the Adaptive Issuance rate is initially kept in a narrow range, between 4.5% and 5.5%. Over the course of 6 months the range gradually widens, eventually spanning from 0.25% to 10%. This is to create a smoother transition for bakers and avoid abrupt fluctuations after activation, which was a concern with the Oxford version.

|

||

| A gradual widening of the range ensures a smooth transition to Adaptive Issuance. |

Only staking rewards. Only rewards associated with staking become variable under Adaptive Issuance, while rewards for Liquidity Baking remain constant (or 0 if turned off).

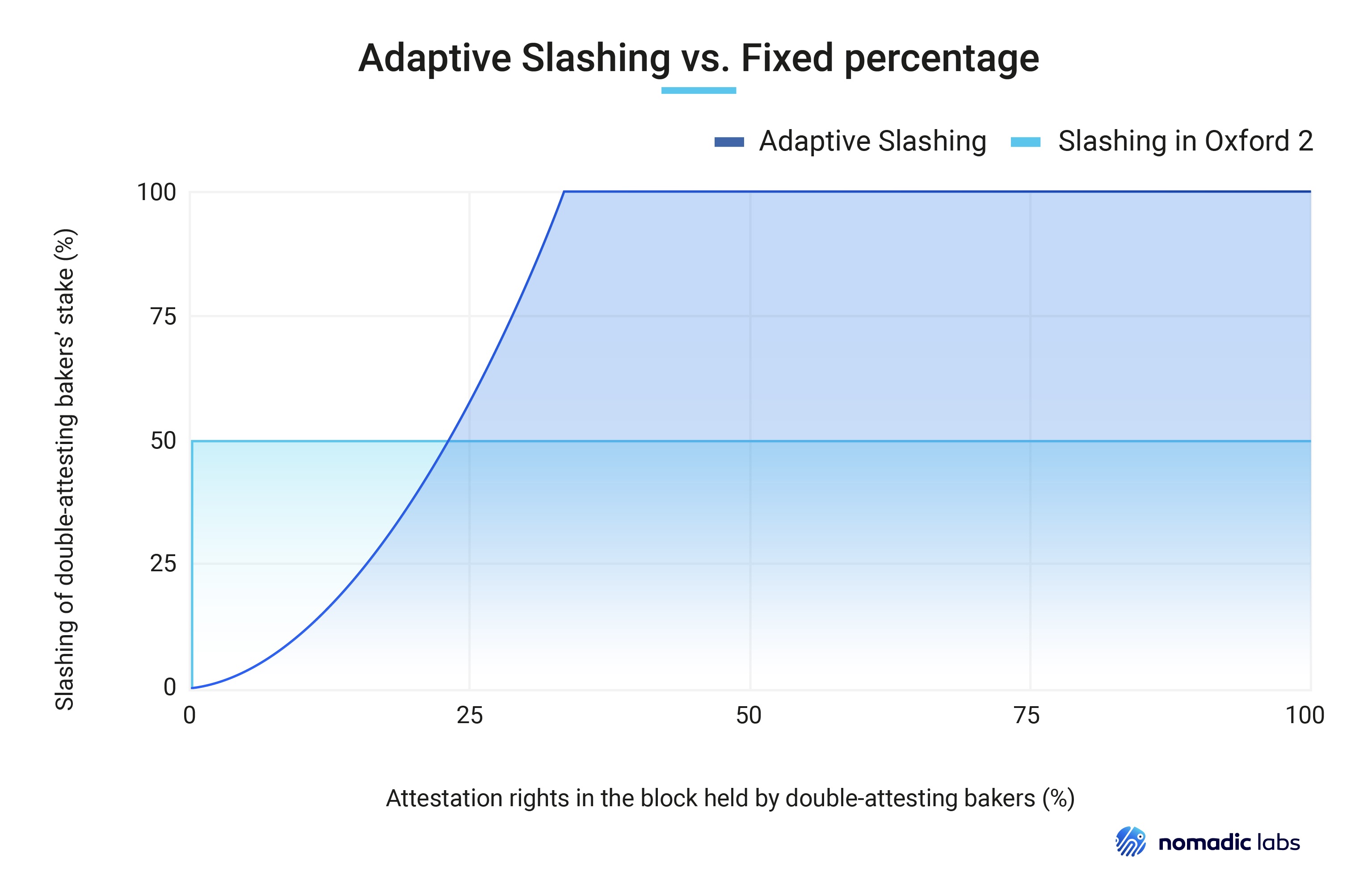

Adaptive Slashing. As slashing no longer only affects the baker, but also directly the baker’s stakers, it becomes more important to differentiate between accidental errors and deliberate attacks. To do so, the penalty for double attestation is made proportional to the share of attestation rights in the block held by bakers involved in double-attestation. It means that accidental double attestations are unlikely to cause extensive slashing, while concerted attacks result in severe penalties. This differs from Oxford / Oxford 2, where a fixed percentage is slashed, regardless of the degree of misconduct.

|

||

| Accidental double attestations are unlikely to cause extensive slashing, while concerted attacks involving many bakers result in severe penalties. |

Manual staking. All stake is handled manually, including when balances change with rewards or incoming transactions. Auto-staking is no longer an option. The reason is that the new staker role introduces complexity that makes it difficult to define a fixed percentage. It also becomes unfeasible for the protocol to calculate auto-staking for both bakers and external stakers, as the number of required calculations goes from around 400 to potentially hundreds of thousands.

Bug fixes. The Oxford proposal contained bugs that have been addressed. While it’s impossible to entirely avoid bugs, we have greatly expanded our testing framework and are continuously working to improve it.

Co-built with ecosystem stakeholders

The Adaptive Issuance mechanism included in the Paris proposal has been built in close cooperation with Tezos bakers, blockchain indexers, tooling providers, and other ecosystem stakeholders. This is part of a longer-running effort to strengthen the collaborative aspect of protocol development.

Adaptive Issuance is a major revision of Tezos staking economics, with significant implications for ecosystem stakeholders, and we are grateful for the time invested by them in helping us shape it. Feedback rounds about progressive min-max, Adaptive Slashing, and in particular the staking UX, have been very fruitful.

With the Paris proposal, we believe that most prevalent points of friction have been identified and addressed, and that the ecosystem is generally better prepared for Adaptive Issuance.

Get involved

It is already possible to experiment with Adaptive Issuance on the Weeklynet testnet, and anyone looking to explore it is highly encouraged to join.

Nomadic Labs’s engineers have played out various realistic scenarios on Weeklynet to showcase the baking and staking user experience, as well as the behavior of Adaptive Issuance and Adaptive Slashing under different conditions. Reports covering the actions and their effects are available here.

Additionally, we’ve released the code for an Adaptive Issuance simulator which can be used to model the behavior of the issuance rate in different scenarios. It also enables estimations of baking rewards for different baker configurations.

For more information, we recommend the Paris proposal announcement. For questions about Adaptive Issuance that may remain unanswered, feel free to reach out.

Adaptive Issuance is an ambitious upgrade which in its functionality embodies the Tezos ethos of constant evolution and adaptation. We are happy to have worked closely with the broader ecosystem on this feature, and it doesn’t stop here.

Close cooperation with bakers and other ecosystem actors is key to creating the best possible blockchain. We look forward to further strengthening this relationship, as the work to improve Tezos continues.