TL;DR: Adaptive Maximum makes the Tezos protocol able to better adapt staking rewards to changing network conditions without governance intervention. It’s a long-term sustainable solution for keeping Tezos’ L1 both secure and economically sound.

This is a joint post from Nomadic Labs, TriliTech, & Functori.

Designing a Proof-of-Stake blockchain requires carefully balancing network security with healthy economics.

The staking mechanism must provide enough rewards to incentivize stakers to secure the network against consensus attacks, but rewards mustn’t be so high that they negatively impact the economics of the system.

Staking rewards are newly created tokens, or, in other words: inflation. As many people have personally experienced in recent years, high inflation can negatively impact economic systems. Prices increase, not because the value of things go up, but because the value of money goes down. Savings are eroded, borrowing costs increase, and there’s more uncertainty about the future.

Blockchains are no different. Excessive inflation dilutes the value of all tokens. It can also dry up liquidity, because the opportunity cost of not staking to compensate for inflation becomes high, which interferes with DeFi applications and layer 2 solutions. It can also create tax inefficiencies. For these reasons, staking rewards should be balanced with the need for security on the network, and be no higher than that.

Adaptive Issuance in Paris

Adaptive Issuance is designed to incentivize staking to ensure a secure network, while minimizing tez issuance.

In Paris, the target for staking is 50% of all tez supply (we’ll get back to why it’s a desirable target). When below the target, the protocol increases rewards issuance to encourage more staking. When above the target, the protocol reduces issuance to avoid excessive inflation.

However, the Paris protocol’s implementation of Adaptive Issuance treats the 50% target as a goal to be achieved no matter the inflationary cost. This can lead to disproportionately high inflation rates in some scenarios.

For example, if the staking ratio stabilizes around 40%, tez issuance could stabilize at 5.5% per year. This is very high tez issuance for a staking ratio that is relatively close to the target, and it fundamentally goes against the intention of Adaptive Issuance. Furthermore, if the staked amount oscillates above or below the target at 50%, we could observe large variations in issuance.

Adaptive Issuance in Quebec

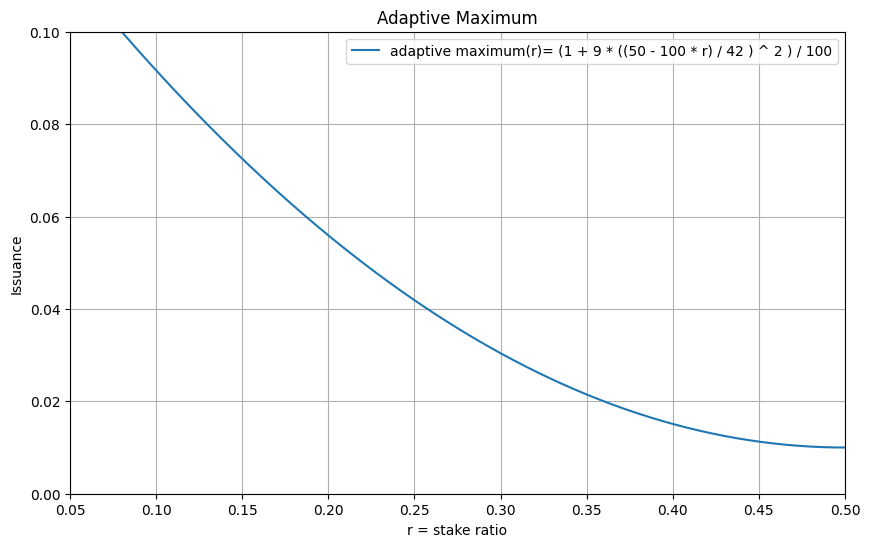

To avoid scenarios like the above, the Quebec proposal implements an ‘Adaptive Maximum’. It is an upper limit for issuance that follows the staking ratio.

At low staking ratios, issuance can be high to strongly incentivize more staking. But when staking is relatively close to the target, the allowed maximum issuance is lowered.

In our example, with a 40% staking ratio, Quebec limits tez issuance to 1.5% per year instead of the 5.5% allowed in the Paris protocol.

The curve below shows how the Adaptive Maximum adjusts as the staking ratio approaches the 50% target.

Changing the target is a short-term solution

The Qena42 proposal excludes the adaptive maximum feature and instead lowers the staking target from 50% to 42%.

The argument is that staking incentives should not gradually drop as staking approaches the target, that 42% is a more realistic target, and that the target can be adjusted further in the future if required.

Changing the target is not the right solution for several reasons.

Simplicity. Blockchain networks are complex and unpredictable systems. Identifying a “perfect” staking target is complex, and it would likely change over time. For such systems, it’s better to operate with simple principles. The 50% target is a good balance between network security and liquidity, and it follows a simple model: For each tez securing the network, there is one tez in circulation.

Security. We still consider 50% attainable. Lowering the target would mean lowering our security ambitions for Tezos.

Moderation. Qena42 addresses the risk of excessive inflation only if the staking ratio stabilizes at 42%. If it stabilizes below, for example, at 35%, we could still see high inflation while being close to the target. Conversely, Adaptive Maximum gradually ‘lowers the heat’’ by reducing issuance as staking approaches the target. It doesn’t just prevent excessive inflation but also reduces the risk of overshooting the target and creating unnecessary volatility.

Timeliness. Recurring manual adjustments through protocol upgrades will each require a full governance cycle. Adjustments would activate at best two and a half months after observing the need, and network conditions could change in the meantime.

Governance. There is a risk of the governance process being held back by recurring and extended discussions about which staking ratio to target. The Adaptive Maximum is designed to be flexible and address a broad range of staking scenarios without governance intervention. It enables the community to focus on other ways to evolve and improve the Tezos protocol.

A solution for long-term sustainability

We acknowledge that 50% may not always be the perfect staking target, but we consider it a good balance between security, simplicity, and feasibility. This makes it desirable for a complex, unpredictable system such as a blockchain network.

The Adaptive Maximum stabilizes network economics by allowing the protocol to adapt if staking finds an equilibrium below 50%. The aim is the efficient use of resources and to ensure that network security is maintained without excessive inflation or recurring governance intervention.

We believe the Quebec proposal thus provides a sustainable, long-term solution that keeps Tezos’ L1 secure and economically sound.

Having presented our arguments for Adaptive Maximum in detail in this post, we want to emphasize that the decision ultimately lies with Tezos’ bakers through on-chain governance. Regardless of the outcome of this governance cycle, we will work to ensure that any adopted proposal is seamlessly activated, and we will, of course, continue to monitor the health of Tezos’ layer 1.