On January 20 2025 20:57:16 UTC, the Tezos blockchain successfully activated the Quebec protocol upgrade at block #7,692,289.

This 17th upgrade was jointly developed by Nomadic Labs, TriliTech, and Functori. It contains the following changes:

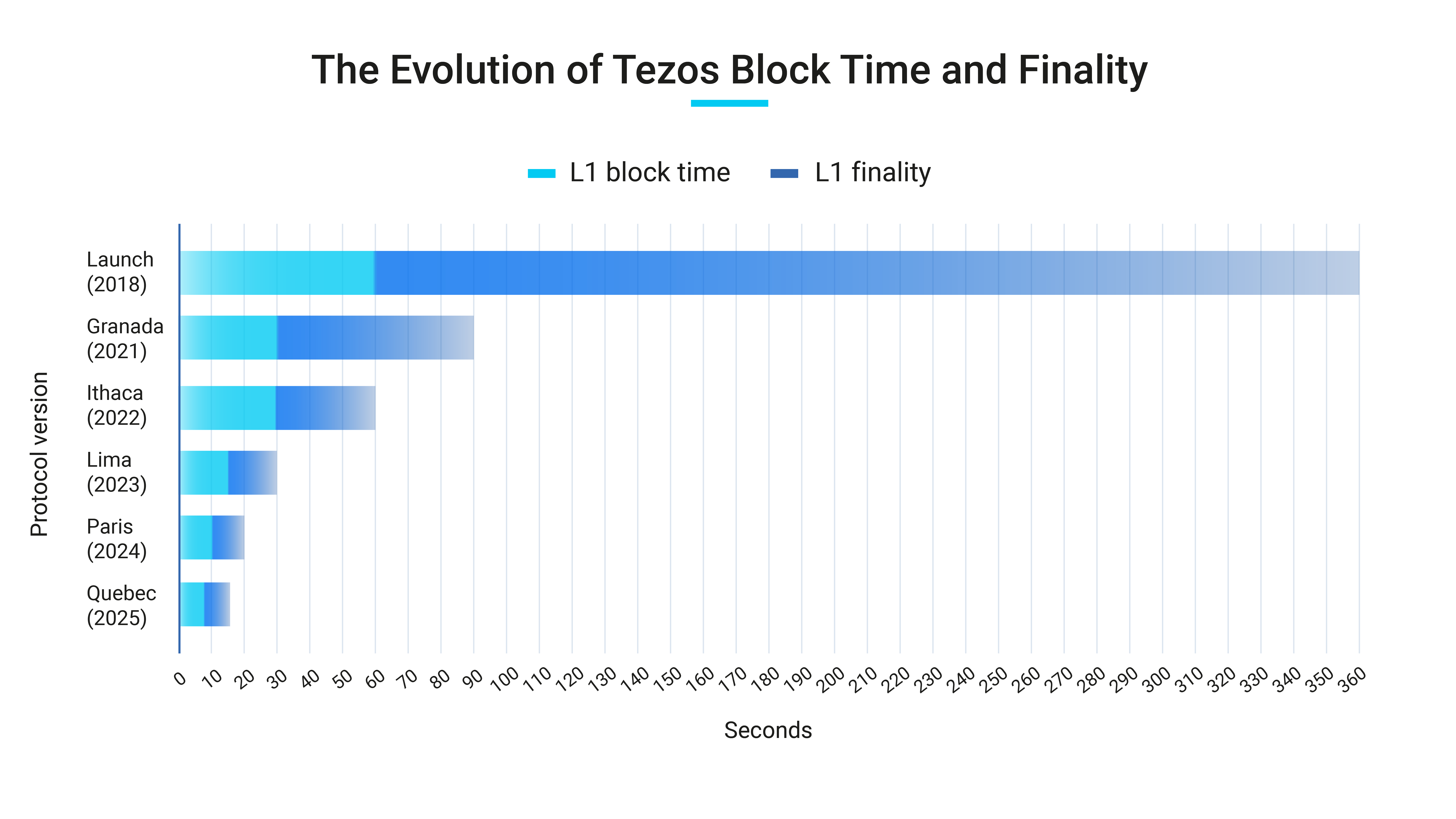

- 8 second block time: Layer 1 block time is reduced from 10 to 8 seconds, bringing lower latency and a finality of just 16 seconds.

- 9x limit for external stake: The limit for how much external stake a baker can accept is raised from 5x to 9x the baker’s own stake.

- Adaptive Maximum: To keep inflation at a minimum, the upper limit for tez issuance is now gradually lowered as network staking approaches the target percentage.

- Lower delegated funds weight: The weight of delegated funds is reduced from 50% to 33% of the nominal value when calculating baking rights and voting power. As a result, staking now yields 3x the rewards vs. delegation, instead of 2x.

- Computation of delegation rights: Quebec amends the mechanism to compute a baker’s minimal delegated balance in a cycle.

A complete list of changes can be found in the protocol’s changelog.

Lower latency, faster finality

In another step on the road to Tezos X, layer 1 block time has been lowered from 10 to 8 seconds.

It means that new transactions are included by the network faster and achieve finality after just 16 seconds (two blocks). In comparison, finality on Ethereum is ~15 minutes (64 blocks), and on Solana it’s ~13 seconds (32 blocks).

|

||

| Continuous protocol improvements have allowed for lower block times and faster finality on Tezos’ layer 1. The result is a faster blockchain and a smoother user experience, all without compromising on decentralization. |

The change to 8-second block time has followed the same thorough benchmarking and testing methodology we applied when lowering the block time to 10 seconds in the Paris protocol.

Importantly, it doesn’t affect the requirements for baking hardware. We stand by our core belief that bakers should be able to take part in Tezos consensus with affordable, low-end infrastructure, preserving community-inclusive decentralization as Tezos evolves.

A note on Ledger hardware wallets: During testing we’ve observed that using the older Ledger Nano S hardware wallet for signing can create a bottleneck for the performance of baking setups. Our benchmarks show that the Ledger Nano S+ and Nano X models perform significantly better. While it doesn’t impact the change to 8 second block time, this difference in performance could become relevant for future block time reductions.

9x limit for external stake

In the Paris protocol, bakers could accept up to 5x their own stake from external stakers. This was a conservative initial choice, intended to allow time for observing staking behavior and further tweaking the mechanism.

Keeping a limit on the external stake ratio reduces centralization risks by preventing the concentration of stake with a few large bakers. It also prevents some scenarios, where bakers could have an incentive to behave against the interests of their stakers and delegators.

Based on network observations, we are confident that it is safe and beneficial for the network to raise the limit from 5x to 9x a baker’s own stake. Raising this limit has been frequently requested by bakers, and we are happy to be able to include it in the Quebec protocol!

Adaptive Maximum

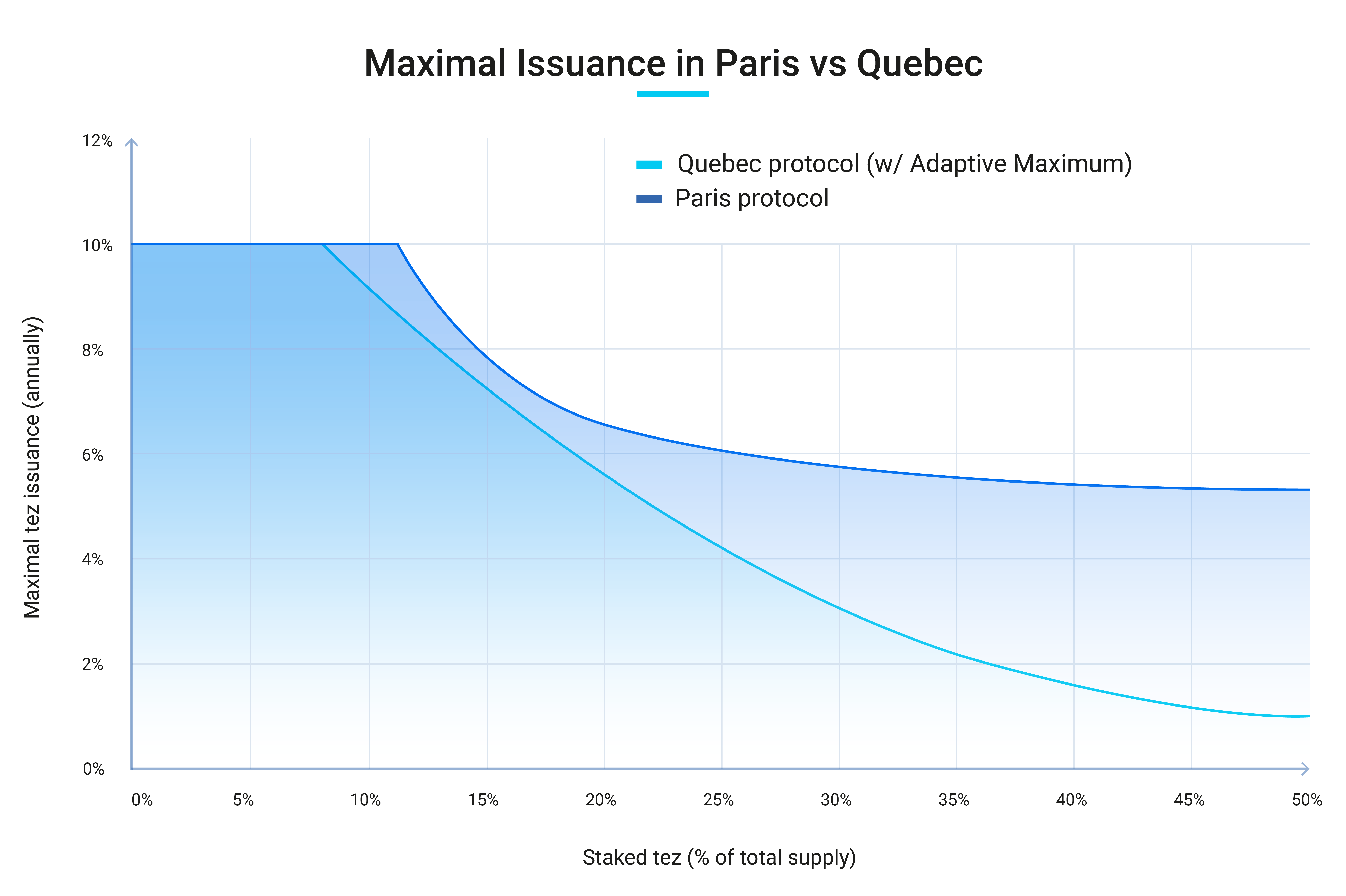

The Adaptive Issuance mechanism is designed to incentivize enough staking to ensure a secure network, while keeping tez issuance at minimum.

When staking is low, the protocol increases rewards issuance to encourage more staking. When staking is closer to the desired level, 50%, the protocol reduces rewards to avoid excessive issuance.

However, the Paris protocol’s implementation of the upper limit for Adaptive Issuance could lead to disproportionately high issuance in certain scenarios where network staking would remain close to 50% without reaching the target.

The Quebec protocol fixes this with the ‘Adaptive Maximum’. At low staking ratios, issuance can still be high to strongly incentivize more staking. But when staking is relatively close to the target, the allowed maximum issuance is lowered.

|

||

| In the Quebec protocol, the upper limit for tez issuance is lowered as staking approaches the 50% target. Note that the graph only shows the upper limits and not the actual issuance rate, which depends on more factors. |

Community governance at work

The activation of Quebec is a testament to the Tezos community’s ability to debate the merits of different upgrade proposals and align on the preferred approach through a well-defined, decentralized, on-chain governance process.

It ensures high legitimacy for each upgrade, which is critical for a well-functioning blockchain and ecosystem. We would like to thank everyone involved!

With Quebec successfully activated, we turn our attention to the upcoming ‘R’ upgrade proposal. On January 11 we published a call for feedback on the proposal, and we have already received extensive feedback that we are currently processing.

We are excited to work with the broader community on evolving the Tezos blockchain again with the ‘R’ proposal. Together we are making Tezos X a reality, step by step!